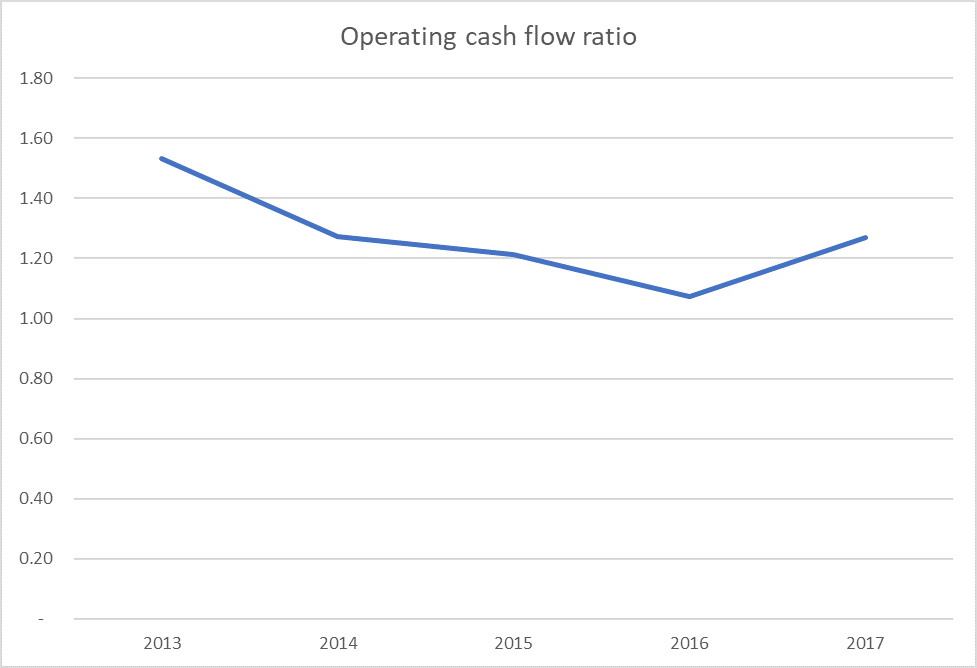

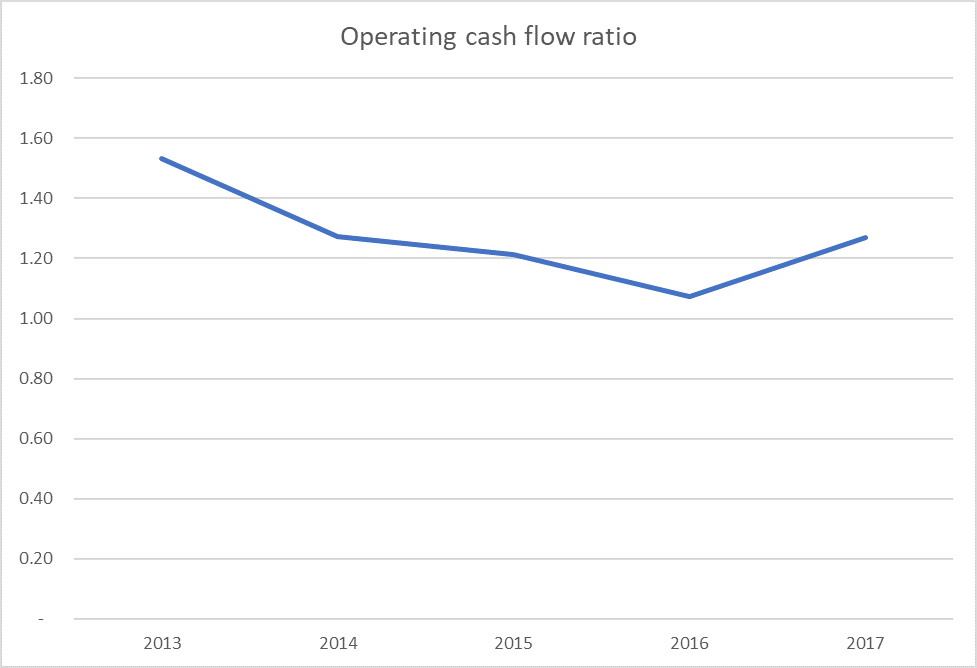

operating cash flow ratio importance

Each part reviews the cash flow from one of three types of activities. Operating Cash Flow.

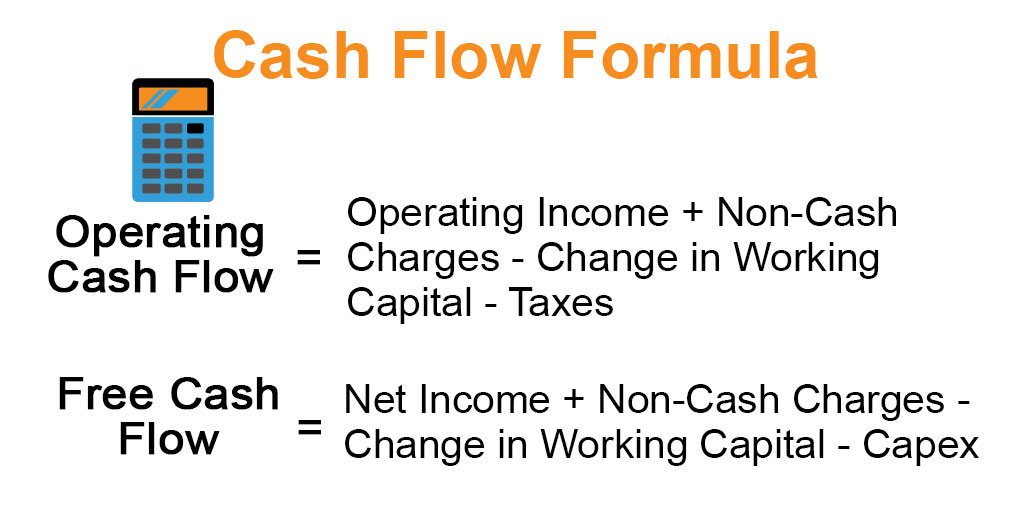

Cash Flow Formula How To Calculate Cash Flow With Examples

And 3 financing activities.

. An investment normally counts as a cash equivalent when it has a short maturity period of 90 days or less and can be included in the. This is a guide to Cash Flow Statement Examples. From this CFS we can see that the net cash flow for the 2017 fiscal year was 1522000.

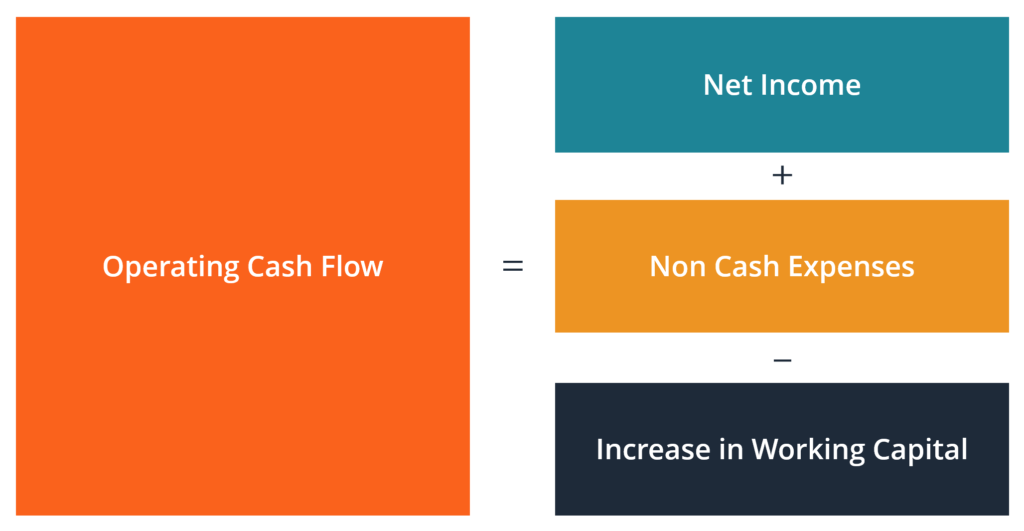

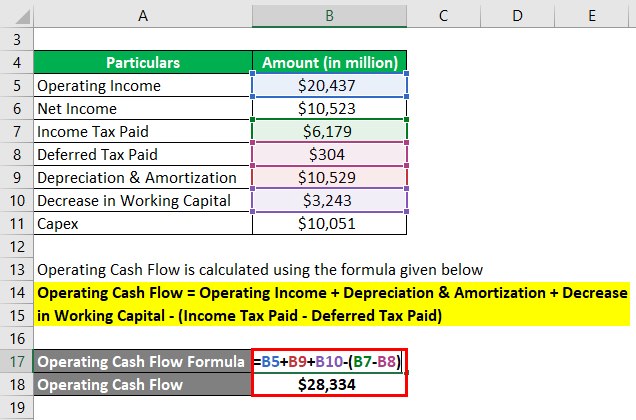

This calculation is simple and accurate but does not give investors much information about the company its operations or the sources of cash. The operating cash flow formula can be calculated two different ways. Cash inflows result from cash sales and collection of accounts receivable.

Cash and cash equivalents CCE are the most liquid current assets found on a businesss balance sheetCash equivalents are short-term commitments with temporarily idle cash and easily convertible into a known cash amount. The first way or the direct method simply subtracts operating expenses from total revenues. Operating activities include a companys day-to-day activities for example purchasing raw materials or making sales.

Cash flow is an important statement that auditors analysts and other parties use to check the sustainability of the net profit. Generally cash flow statements are divided into three main parts. Operating cash flow is an important benchmark for an analyst to determine the companys financial stability using its core business activities.

If cash flow is not showing any jump then most of the sales are made on credit and there is a risk regarding the recovery. The importance of Operating activities. Return on invested capital gives a.

The bulk of the positive cash flow stems from cash earned from operations which is a good sign for investors. Learn Basic Accounting Ratio Analysis Tutorial Accounting Interview Questions Debit vs Credit in Accounting Accounting Equation. The bottom line of the cash flow statement shows the net increase or decrease in cash for the period.

Return On Invested Capital - ROIC. A calculation used to assess a companys efficiency at allocating the capital under its control to profitable investments. The cash flow generated from operating activities is termed operating cash flow.

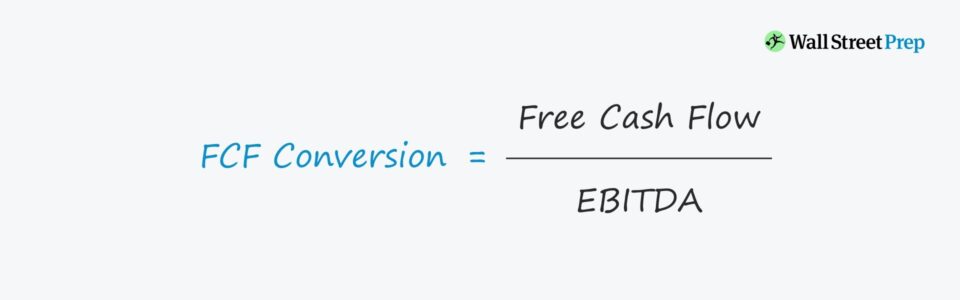

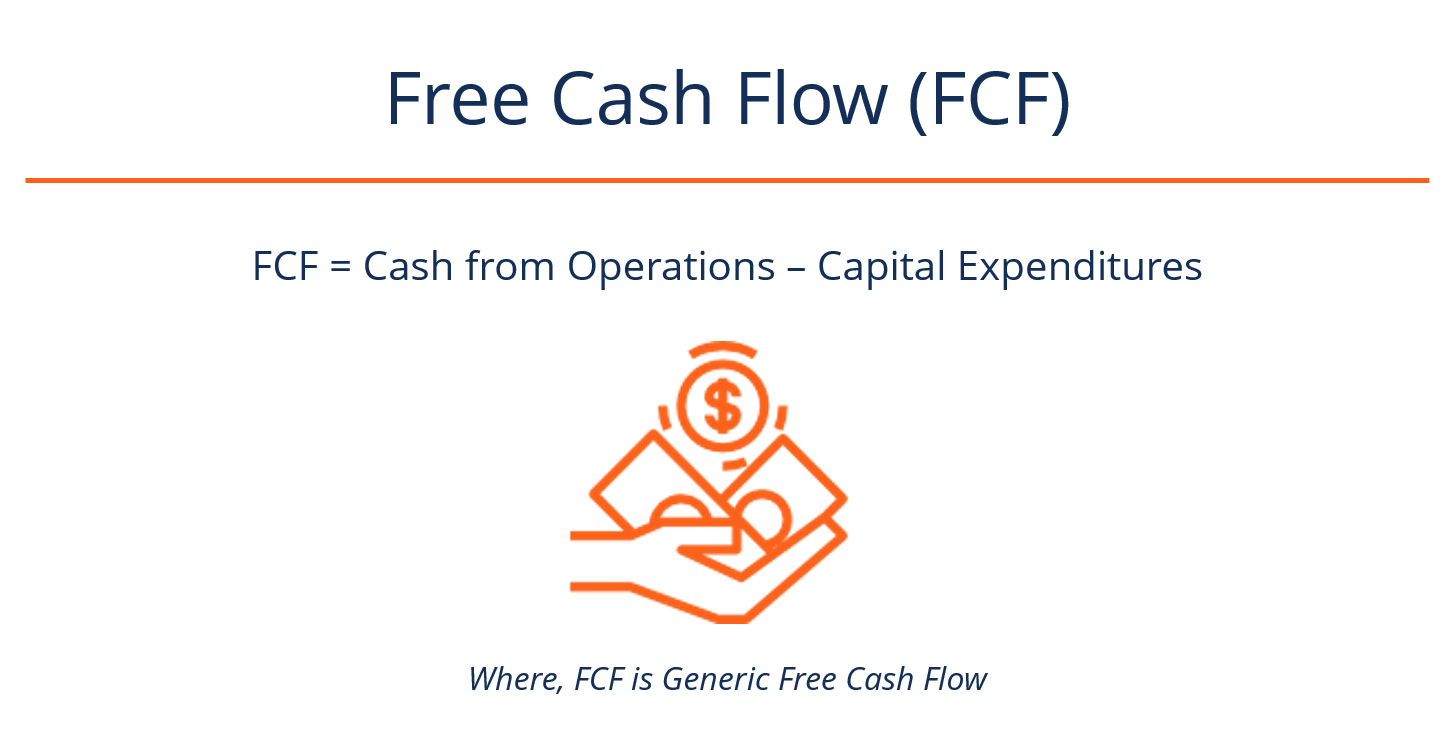

Free Cash Flow Conversion Fcf Formula And Example Analysis

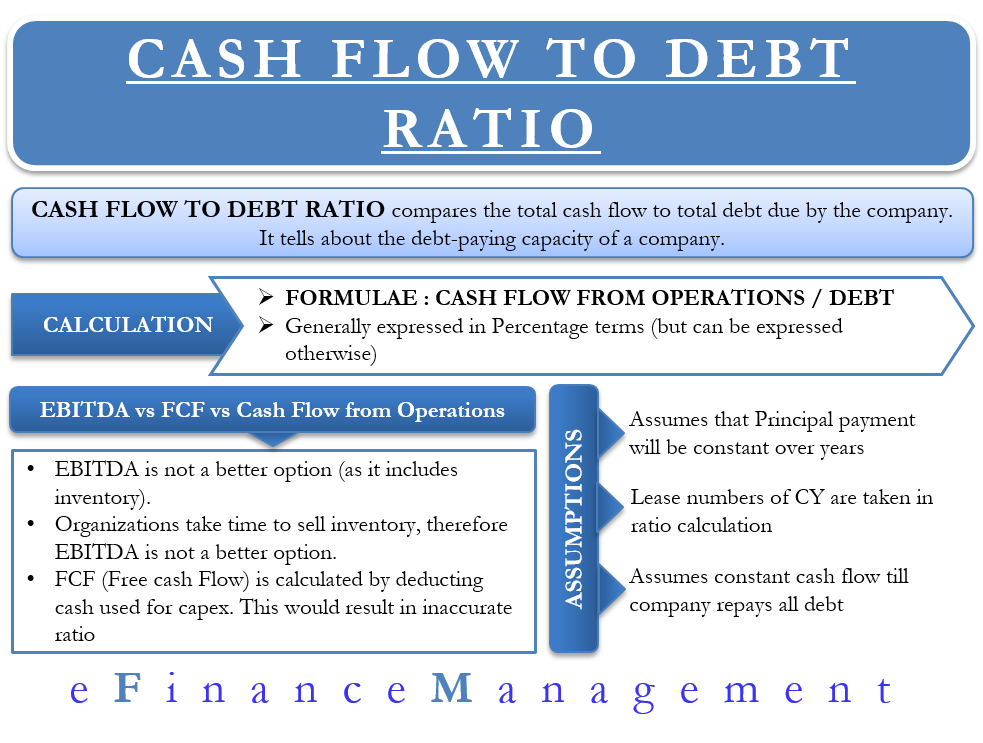

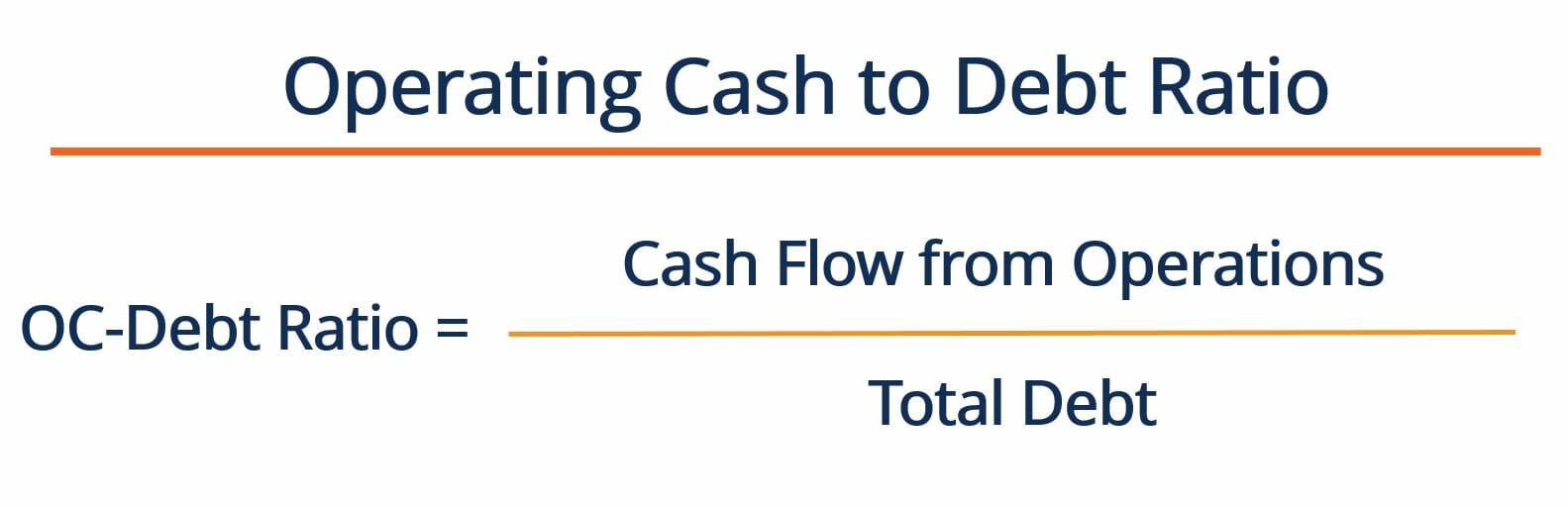

Cash Flow To Debt Ratio Meaning Importance Calculation

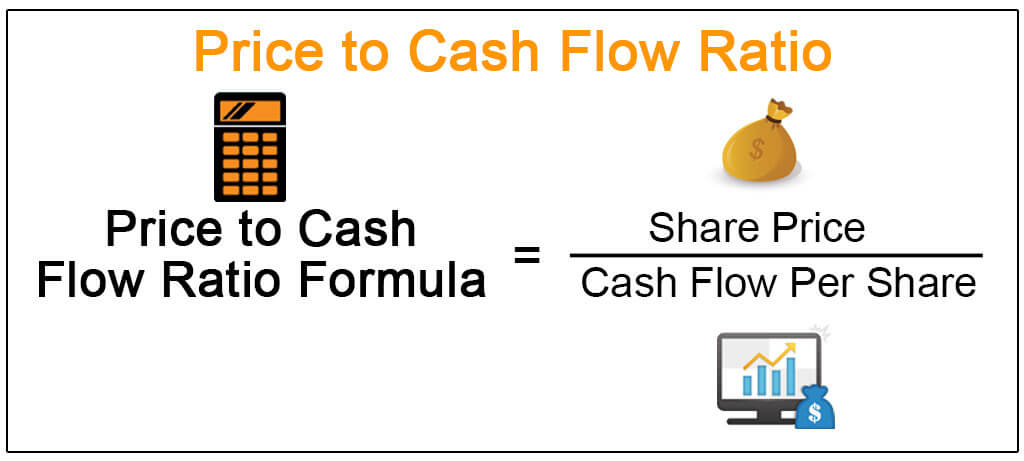

Price To Cash Flow Formula Example Calculate P Cf Ratio

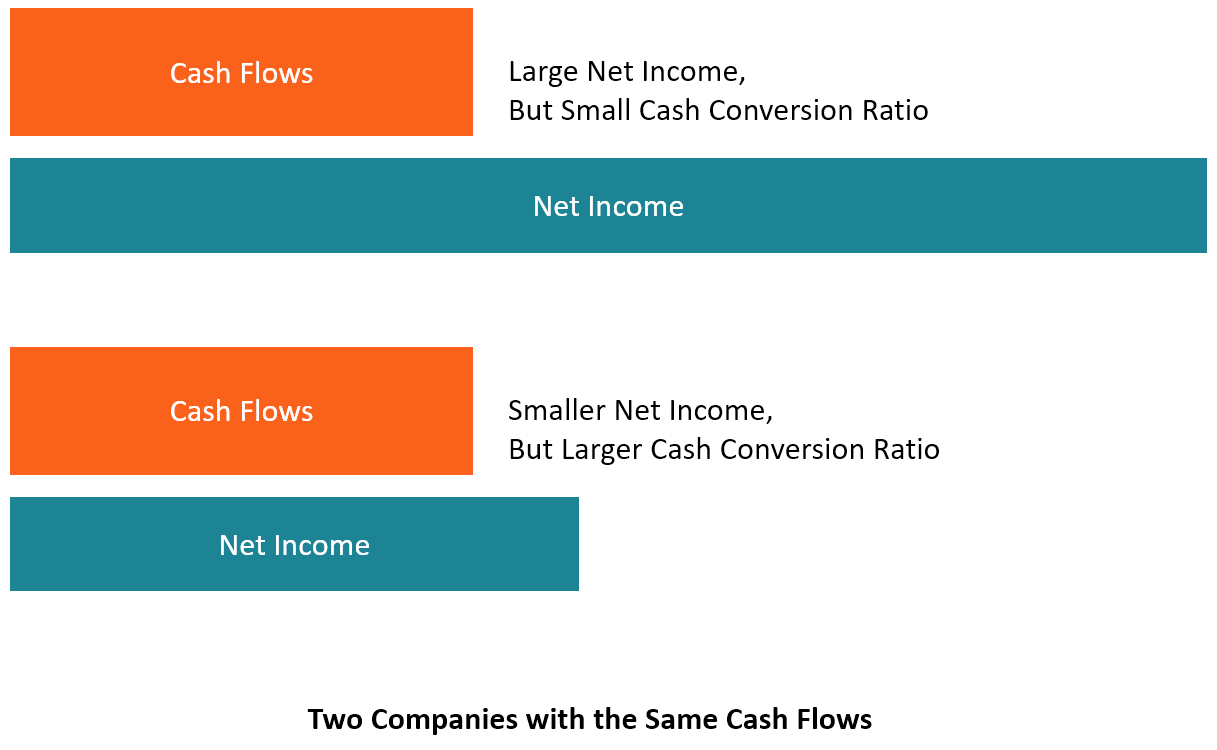

Cash Conversion Ratio Comparing Cash Flow Vs Profit Of A Business

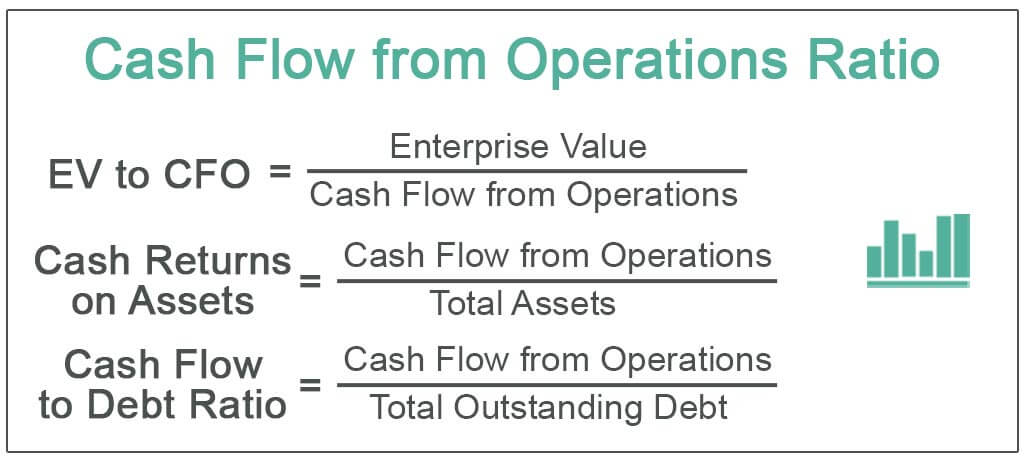

Cash Flow From Operations Ratio Formula Examples

Fcf Formula Formula For Free Cash Flow Examples And Guide

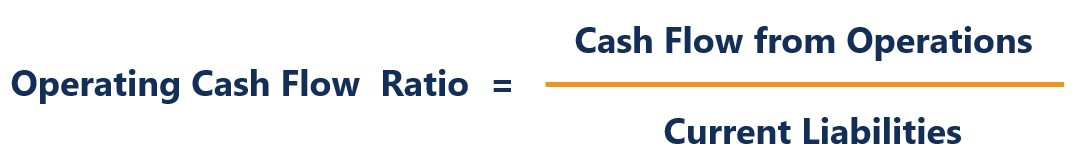

Operating Cash Flow Ratio Formula Guide For Financial Analysts

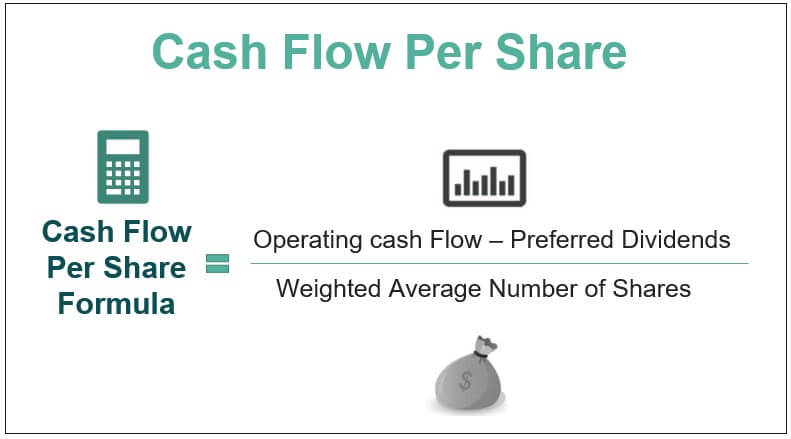

Cash Flow Per Share Formula Example How To Calculate

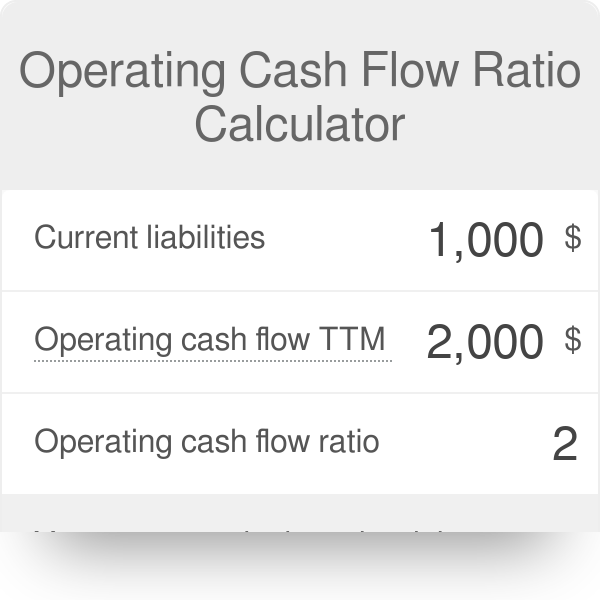

Operating Cash Flow Ratio Calculator

Operating Cash Flow Definition Formula And Examples

Operating Cash Flow Ratio Definition Formula Example

Cash Flow Formula How To Calculate Cash Flow With Examples

Price To Cash Flow Ratio P Cf Formula And Calculation

Free Cash Flow Formula Calculator Excel Template

Cash Conversion Ratio Financial Edge

Operating Cash To Debt Ratio Definition And Example Corporate Finance Institute

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-03-2c4a6ea86c4b4b13b8a440cee78fac7d.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)